Monmouth County has 3,768 positive cases of COVID-19

April 12, 2020

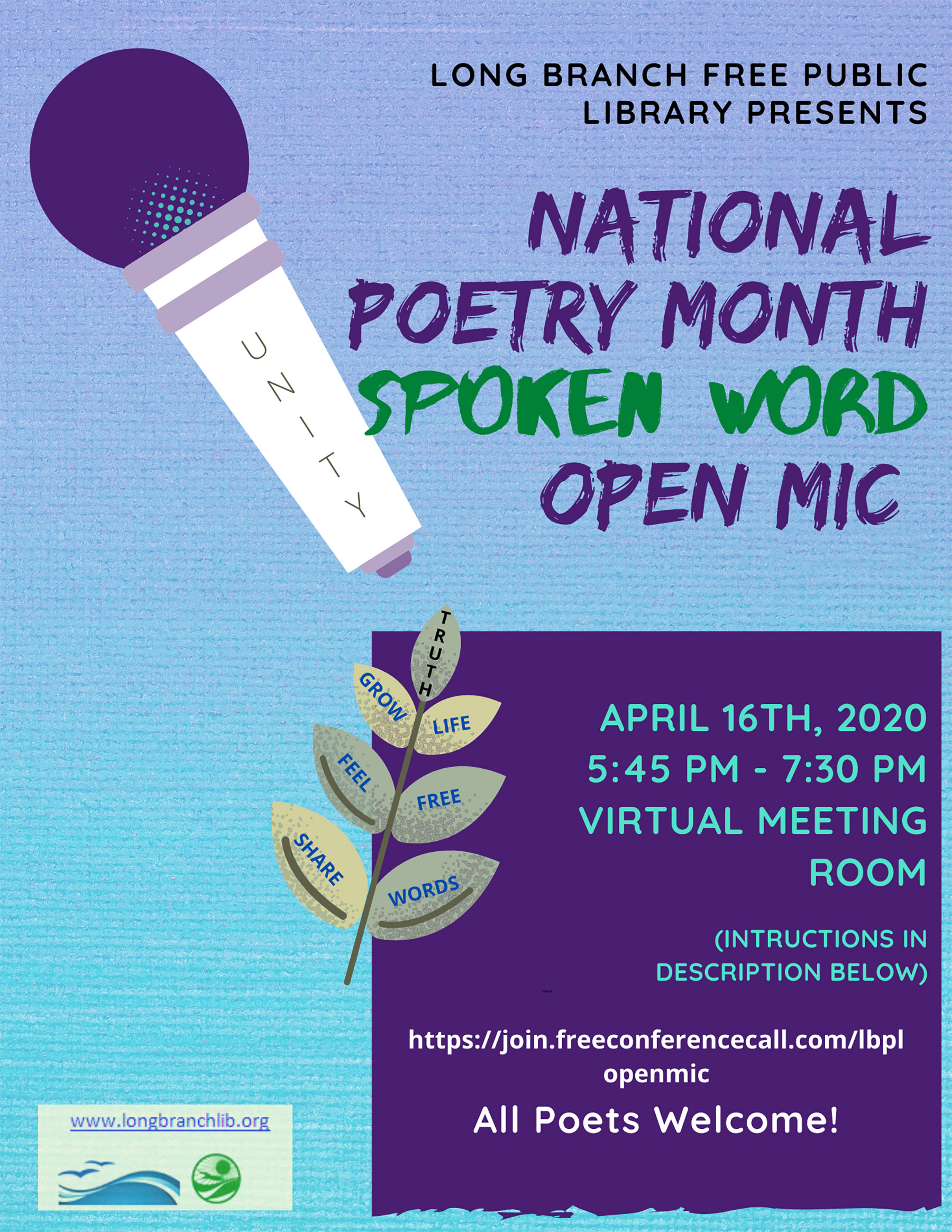

Spoken Word Poetry Month at Long Branch Library

April 13, 2020From the Legislature

By Vin Gopal, Eric Houghtaling and Joann Downey

There has been a great deal of discussion in the news about the federal government’s $2 trillion stimulus package, known as the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, that was signed into law on March 27. Here’s a look at some of the ways the CARES Act will impact New Jersey and Monmouth County residents.

The majority of New Jersey residents will receive one-time direct stimulus payments. About 92 percent of individual taxpayers will receive payments of up to $1,200 while 80 percent of married couples will get up to $2,400. Families and individuals with children will also receive $500 per child. The stimulus, or Economic Impact Payments, are automatic for most taxpayers. No further action is needed by taxpayers who filed tax returns in 2018 or 2019 and people already receiving Social Security retirement, disability (SSDI), or survivor benefits. All others should go to irs.gov and choose “Get info on economic impact payments” to enter their bank account information for direct deposit.

The payments begin decreasing for individuals whose adjusted gross income is $75,000 or more. Singles whose income is $99,000 or more and couples who earn $198,000 or more will not receive a stimulus check. For couples who file joint tax returns, stimulus checks start decreasing after $150,000 in income.

With people losing their jobs at historic rates due to the shutdown of businesses because of COVID-19, the state Department of Labor reported that new unemployment claims rose to 576,904 from March 15 to April 4 and continue to rise. The federal stimulus package will provide an additional $600 per week in expanded Unemployment Insurance for out-of-work New Jerseyans. That means residents will receive their base weekly unemployment benefit plus an additional $600 through July 2020. For people already collecting unemployment, the additional payments, which will be made separately from unemployment checks, are scheduled to start arriving to laid-off workers this week.

In addition, the CARES Act broadens unemployment assistance to cover residents who were previously ineligible, allowing independent contractors and workers in the “gig economy” to qualify for these benefits as well.

The Act includes the Paycheck Protection Program, which makes loans of up to $10 million to help New Jersey’s small businesses stay afloat so they can keep their workers employed. The Paycheck Protection Program loans are forgivable if 75% of the loan is used for payroll costs. You will also owe money if you do not maintain your staff and payroll.

The stimulus package includes $62.6 million to help New Jersey healthcare workers pay for child care. That money also will be available to emergency responders, sanitation workers, and essential employees. It can help fund child care facilities that could be forced to shut down or are hurting because of decreased enrollment due to the coronavirus.

In addition, the Centers for Disease Control is providing $15.4 million to help New Jersey health workers obtain personal protective equipment (PPE) and to expand testing for the coronavirus. The federal stimulus also will provide state and local police departments and jails with $18.3 million in Byrne-JAG grants, awarded through the U.S. Justice Department, to buy equipment, including PPE and other medical items.

There are a number of appropriations under the CARES Act for programs that help our state’s most vulnerable residents, including $70 million for food stamps under the Supplemental Nutrition Assistance Program (SNAP) and another $53 million to help homeless individuals. The Act appropriates $1.7 million to help low-income New Jersey residents living with HIV/AIDS through the Housing Opportunities for Persons with AIDS Program.

Monmouth County will share in the $53.5 million in Community Development Block Grants (CDBG) awarded to New Jersey under the CARES Act. CDBG funds are used to pay for infrastructure, economic development projects, community centers, housing rehabilitation, and homeowners assistance. Monmouth County will receive $1,595,421, including $243,463 in CDBG dollars earmarked for Asbury Park and another $295,390 for Long Branch.

The CARES Act also provides money to support New Jersey schools – $310 million for K-12 education for various projects, including helping teachers and students make the transition to online remote learning. It provides another $316 million in direct grants to help universities and colleges transition to distance education and to help students meet their emergency financial needs.

While the CARES Act will not solve all of the health and financial challenges Monmouth County residents face, these funds will help get us through the trying times ahead. If you have questions or concerns about programs available to help you, please contact our District 11 Legislative office at (732) 695-3371. We are here to help.

Until next time, stay safe.