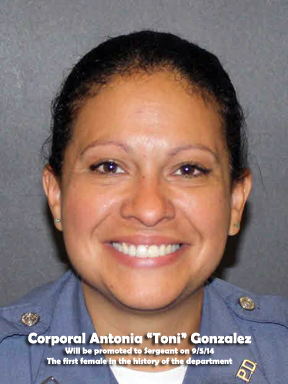

Exploring law enforcement

August 22, 2014

Gonzalez will be first female sergeant in LBPD history

August 24, 2014Bank of America to Pay $16.65 Billion in Historic Justice Department Settlement for Financial Fraud Leading up to and During the Financial Crisis

Attorney General Eric Holder and Associate Attorney General Tony West announced today that the Department of Justice has reached a $16.65 billion settlement with Bank of America Corporation – the largest civil settlement with a single entity in American history ¬— to resolve federal and state claims against Bank of America and its former and current subsidiaries, including Countrywide Financial Corporation and Merrill Lynch. As part of this global resolution, the bank has agreed to pay a $5 billion penalty under the Financial Institutions Reform, Recovery and Enforcement Act (FIRREA) – the largest FIRREA penalty ever – and provide billions of dollars of relief to struggling homeowners, including funds that will help defray tax liability as a result of mortgage modification, forbearance or forgiveness. The settlement does not release individuals from civil charges, nor does it absolve Bank of America, its current or former subsidiaries and affiliates or any individuals from potential criminal prosecution.

“This historic resolution – the largest such settlement on record – goes far beyond ‘the cost of doing business,’” said Attorney General Holder. “Under the terms of this settlement, the bank has agreed to pay $7 billion in relief to struggling homeowners, borrowers and communities affected by the bank’s conduct. This is appropriate given the size and scope of the wrongdoing at issue.”

This settlement is part of the ongoing efforts of President Obama’s Financial Fraud Enforcement Task Force and its Residential Mortgage-Backed Securities (RMBS) Working Group, which has recovered $36.65 billion to date for American consumers and investors.

“At nearly $17 billion, today’s resolution with Bank of America is the largest the department has ever reached with a single entity in American history,” said Associate Attorney General West. “But the significance of this settlement lies not just in its size; this agreement is notable because it achieves real accountability for the American people and helps to rectify the harm caused by Bank of America’s conduct through a $7 billion consumer relief package that could benefit hundreds of thousands of Americans still struggling to pull themselves out from under the weight of the financial crisis.”

The Justice Department and the bank settled several of the department’s ongoing civil investigations related to the packaging, marketing, sale, arrangement, structuring and issuance of RMBS, collateralized debt obligations (CDOs), and the bank’s practices concerning the underwriting and origination of mortgage loans. The settlement includes a statement of facts, in which the bank has acknowledged that it sold billions of dollars of RMBS without disclosing to investors key facts about the quality of the securitized loans. When the RMBS collapsed, investors, including federally insured financial institutions, suffered billions of dollars in losses. The bank has also conceded that it originated risky mortgage loans and made misrepresentations about the quality of those loans to Fannie Mae, Freddie Mac and the Federal Housing Administration (FHA).

Of the record-breaking $16.65 billion resolution, almost $10 billion will be paid to settle federal and state civil claims by various entities related to RMBS, CDOs and other types of fraud. Bank of America will pay a $5 billion civil penalty to settle the Justice Department claims under FIRREA. Approximately $1.8 billion will be paid to settle federal fraud claims related to the bank’s origination and sale of mortgages, $1.03 billion will be paid to settle federal and state securities claims by the Federal Deposit Insurance Corporation (FDIC), $135.84 million will be paid to settle claims by the Securities and Exchange Commission. In addition, $300 million will be paid to settle claims by the state of California, $45 million to settle claims by the state of Delaware, $200 million to settle claims by the state of Illinois, $23 million to settle claims by the Commonwealth of Kentucky, $75 million to settle claims by the state of Maryland, and $300 million to settle claims by the state of New York.

Bank of America will provide the remaining $7 billion in the form of relief to aid hundreds of thousands of consumers harmed by the financial crisis precipitated by the unlawful conduct of Bank of America, Merrill Lynch and Countrywide. That relief will take various forms, including principal reduction loan modifications that result in numerous homeowners no longer being underwater on their mortgages and finally having substantial equity in their homes. It will also include new loans to credit worthy borrowers struggling to get a loan, donations to assist communities in recovering from the financial crisis, and financing for affordable rental housing. Finally, Bank of America has agreed to place over $490 million in a tax relief fund to be used to help defray some of the tax liability that will be incurred by consumers receiving certain types of relief if Congress fails to extend the tax relief coverage of the Mortgage Forgiveness Debt Relief Act of 2007.

An independent monitor will be appointed to determine whether Bank of America is satisfying its obligations. If Bank of America fails to live up to its agreement by Aug. 31, 2018, it must pay liquidated damages in the amount of the shortfall to organizations that will use the funds for state-based Interest on Lawyers’ Trust Account (IOLTA) organizations and NeighborWorks America, a non-profit organization and leader in providing affordable housing and facilitating community development. The organizations will use the funds for foreclosure prevention and community redevelopment, legal assistance, housing counselling and neighborhood stabilization.

As part of the RMBS Working Group, the U.S. Attorney’s Office for the District of New Jersey conducted a FIRREA investigation into misrepresentations made by Merrill Lynch to investors in 72 RMBS throughout 2006 and 2007. As the statement of facts describes, Merrill Lynch regularly told investors the loans it was securitizing were made to borrowers who were likely and able to repay their debts. Merrill Lynch made these representations even though it knew, based on the due diligence it had performed on samples of the loans, that a significant number of those loans had material underwriting and compliance defects – including as many as 55 percent in a single pool. In addition, Merrill Lynch rarely reviewed the unsampled loans to ensure that the defects observed in the samples were not present throughout the remainder of the pools. Merrill Lynch also disregarded its own due diligence and securitized loans that the due diligence vendors had identified as defective. This practice led one Merrill Lynch consultant to “wonder why we have due diligence performed” if Merrill Lynch was going to securitize the loans “regardless of issues.”

“In the run-up to the financial crisis, Merrill Lynch bought more and more mortgage loans, packaged them together, and sold them off in securities – even when the bank knew a substantial number of those loans were defective,” said U.S. Attorney Paul J. Fishman for the District of New Jersey. “The failure to disclose known risks undermines investor confidence in our financial institutions. Today’s record-breaking settlement, which includes the resolution of our office’s imminent multibillion-dollar suit for FIRREA penalties, reflects the seriousness of the lapses that caused staggering losses and wider economic damage.”

This settlement also resolves the complaint filed against Bank of America in August 2013 by the U.S. Attorney’s Office for the Western District of North Carolina concerning an $850 million securitization. Bank of America acknowledges that it marketed this securitization as being backed by bank-originated “prime” mortgages that were underwritten in accordance with its underwriting guidelines. Yet, Bank of America knew that a significant number of loans in the security were “wholesale” mortgages originated through mortgage brokers and that based on its internal reporting, such loans were experiencing a marked increase in underwriting defects and a noticeable decrease in performance. Notwithstanding these red flags, the bank sold these RMBS to federally backed financial institutions without conducting any third party due diligence on the securitized loans and without disclosing key facts to investors in the offering documents filed with the SEC. A related case concerning the same securitization was filed by the SEC against Bank of America and is also being resolved as part of this settlement.

“Today’s settlement attests to the fact that fraud pervaded every level of the RMBS industry, including purportedly prime securities, which formed the basis of our filed complaint,” said U.S. Attorney Anne M. Tompkins for the Western District of North Carolina. “Even reputable institutions like Bank of America caved to the pernicious forces of greed and cut corners, putting profits ahead of their customers. As we deal with the aftermath of the financial meltdown and rebuild our economy, we will hold accountable firms that contributed to the economic crisis. Today’s settlement makes clear that my office will not sit idly while fraud occurs in our backyard.”

The U.S. Attorney’s Office for the Central District of California has been investigating the origination and securitization practices of Countrywide as part of the RMBS Working Group effort. The statement of facts describes how Countrywide typically represented to investors that it originated loans based on underwriting standards that were designed to ensure that borrowers could repay their loans, although Countrywide had information that certain borrowers had a high probability of defaulting on their loans. Countrywide also concealed from RMBS investors its use of “shadow guidelines” that permitted loans to riskier borrowers than Countrywide’s underwriting guidelines would otherwise permit. Countrywide’s origination arm was motivated by the “saleability” of loans and Countrywide was willing to originate “exception loans” (i.e., loans that fell outside of its underwriting guidelines) so long as the loans, and the attendant risk, could be sold. This led Countrywide to expand its loan offerings to include, for example, “Extreme Alt-A” loans, which one Countrywide executive described as a “hazardous product,” although Countrywide failed to tell RMBS investors that these loans were being originated outside of Countrywide’s underwriting guidelines. Countrywide knew that these exception loans were performing far worse than loans originated without exceptions, although it never disclosed this fact to investors.

“The Central District of California has taken the lead in the department’s investigation of Countrywide Financial Corporation,” said Acting U.S. Attorney Stephanie Yonekura for the Central District of California. “Countrywide’s improper securitization practices resulted in billions of dollars of losses to federally-insured financial institutions. We are pleased that this investigation has resulted in a multibillion-dollar recovery to compensate the United States for the losses caused by Countrywide’s misconduct.”

In addition to the matters relating to the securitization of toxic mortgages, today’s settlement also resolves claims arising out of misrepresentations made to government entities concerning the origination of residential mortgages.

The U.S. Attorney’s Office for the Southern District of New York, along with the Federal Housing Finance Agency’s Office of Inspector General and the Special Inspector General for the Troubled Asset Relief Program, conducted investigations into the origination of defective residential mortgage loans by Countrywide’s Consumer Markets Division and Bank of America’s Retail Lending Division as well as the fraudulent sale of such loans to the government sponsored enterprises Fannie Mae and Freddie Mac (the “GSEs”). The investigation into these practices, as well as three private whistleblower lawsuits filed under seal pursuant to the False Claims Act, are resolved in connection with this settlement. As part of the settlement, Countrywide and Bank of America have agreed to pay $1 billion to resolve their liability under the False Claims Act. The FIRREA penalty to be paid by Bank of America as part of the settlement also resolves the government’s claims against Bank of America and Countrywide under FIRREA for loans fraudulently sold to Fannie Mae and Freddie Mac. In addition, Countrywide and Bank of America made admissions concerning their conduct, including that they were aware that many of the residential mortgage loans they had made to borrowers were defective, that many of the representations and warranties they made to the GSEs about the quality of the loans were inaccurate, and that they did not self-report to the GSEs mortgage loans they had internally identified as defective.

“For years, Countrywide and Bank of America unloaded toxic mortgage loans on the government sponsored enterprises Fannie Mae and Freddie Mac with false representations that the loans were quality investments,” said U.S. Attorney Preet Bharara for the Southern District of New York. “This office has already obtained a jury verdict of fraud and a judgment for over a billion dollars against Countrywide and Bank of America for engaging in similar conduct. Now, this settlement, which requires the bank to pay another billion dollars for false statements to the GSEs, continues to send a clear message to Wall Street that mortgage fraud cannot be a cost of doing business.”

The U.S. Attorney’s Office for the Eastern District of New York, together with its partners from the Department of Housing and Urban Development (HUD), conducted a two-year investigation into whether Bank of America knowingly made loans insured by the FHA in violation of applicable underwriting guidelines. The investigation established that the bank caused the FHA to insure loans that were not eligible for FHA mortgage insurance. As a result, HUD incurred hundreds of millions of dollars of losses. Moreover, many of Bank of America’s borrowers have defaulted on their FHA mortgage loans and have either lost or are in the process of losing their homes to foreclosure.

“As a Direct Endorser of FHA insured loans, Bank of America performs a critical role in home lending,” said U.S. Attorney Loretta E. Lynch for the Eastern District of New York. “It is a gatekeeper entrusted with the authority to commit government funds earmarked for facilitating mortgage lending to first-time and low-income homebuyers, senior citizen homeowners and others seeking or owning homes throughout the nation, including many who live in the Eastern District of New York. In obtaining a payment of $800 million and sweeping relief for troubled homeowners, we have not just secured a meaningful remedy for the bank’s conduct, but have sent a powerful message of deterrence.”

“Bank of America failed to make accurate and complete disclosure to investors and its illegal conduct kept investors in the dark,” said Rhea Kemble Dignam, Regional Director of the SEC’s Atlanta Office. “Requiring an admission of wrongdoing as part of Bank of America’s agreement to resolve the SEC charges filed today provides an additional level of accountability for its violation of the federal securities laws.”

“Today’s settlement with Bank of America is another important step in the Obama Administration’s efforts to provide relief to American homeowners who were hurt during the housing crisis,” said U.S. Department of Housing and Urban Development (HUD) Secretary Julián Castro. “This global settlement will strengthen the FHA fund and Ginnie Mae, and it will provide $7 billion in consumer relief with a focus on helping borrowers in areas that were the hardest hit during the crisis. HUD will continue working with the Department of Justice, state attorneys general, and other partners to take appropriate action to hold financial institutions accountable and provide consumers with the relief they need to stay in their homes. HUD remains committed to solidifying the housing recovery and creating more opportunities for Americans to succeed.”

“Bank of America and the banks it bought securitized billions of dollars of defective mortgages,” said Acting Inspector General Michael P. Stephens of the FHFA-OIG. “Investors, including Fannie Mae and Freddie Mac, suffered enormous losses by purchasing RMBS from Bank of America, Countrywide and Merrill Lynch not knowing about those defects. Today’s settlement is a significant, but by no means final step by FHFA-OIG and its law enforcement partners to hold accountable those who committed acts of fraud and deceit.”

The attorneys general of California, Delaware, Illinois, Kentucky, Maryland and New York also conducted related investigations that were critical to bringing about this settlement. In addition, the settlement resolves investigations conducted by the Securities and Exchange Commission (SEC) and litigation filed by the Federal Deposit Insurance Company (FDIC).

The RMBS Working Group is a federal and state law enforcement effort focused on investigating fraud and abuse in the RMBS market that helped lead to the 2008 financial crisis. The RMBS Working Group brings together more than 200 attorneys, investigators, analysts and staff from dozens of state and federal agencies including the Department of Justice, 10 U.S. Attorneys’ Offices, the FBI, the Securities and Exchange Commission (SEC), the Department of Housing and Urban Development (HUD), HUD’s Office of Inspector General, the FHFA-OIG, the Office of the Special Inspector General for the Troubled Asset Relief Program, the Federal Reserve Board’s Office of Inspector General, the Recovery Accountability and Transparency Board, the Financial Crimes Enforcement Network, and more than 10 state attorneys general offices around the country.

The RMBS Working Group is led by Director Geoffrey Graber and five co-chairs: Assistant Attorney General for the Civil Division Stuart Delery, Assistant Attorney General for the Criminal Division Leslie Caldwell, Director of the SEC’s Division of Enforcement Andrew Ceresney, U.S. Attorney for the District of Colorado John Walsh and New York Attorney General Eric Schneiderman.

Investigations were led by Assistant U.S. Attorneys Leticia Vandehaar of the District of New Jersey; Dan Ryan and Mark Odulio of the Western District of North Carolina; George Cardona and Lee Weidman of the Central District of Carolina; Richard Hayes and Kenneth Abell of the Eastern District of New York; and Pierre Armand and Jaimie Nawaday of the Southern District of New York.