Ninth whale washes up on Manasquan beach

February 14, 2023

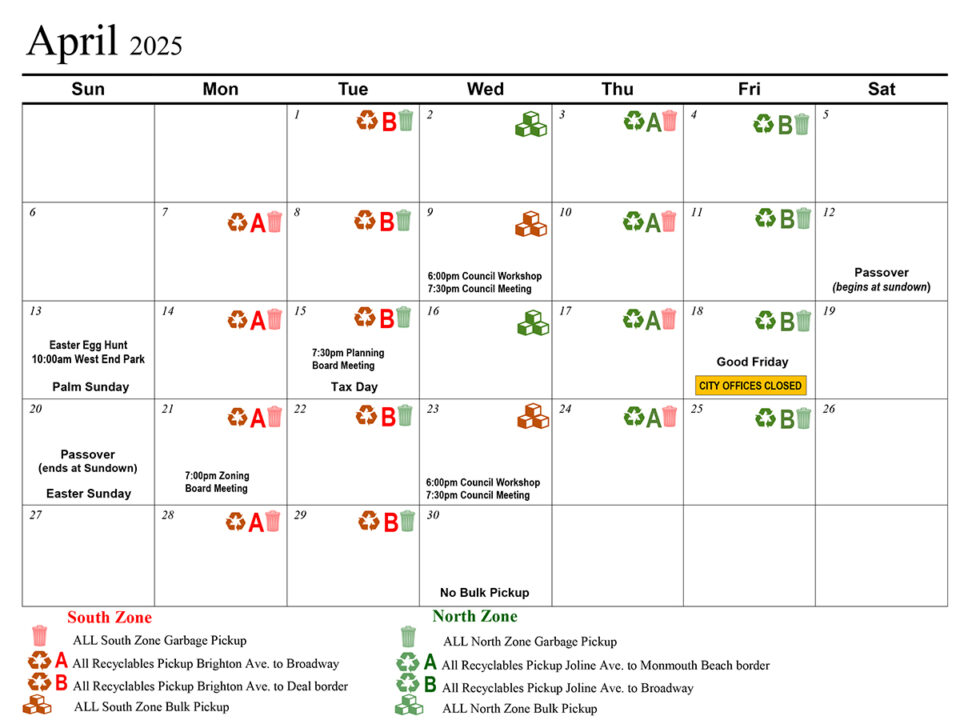

Upcoming Black History Month events at the Long Branch Arts and Cultural Center

February 15, 2023By Vin Gopal

The Legislative District 11 Senate office has been reaching out to residents to make sure they know about the ANCHOR property tax rebate program and help them with information about applying. The deadline to apply is February 28, 2023.

Affordable New Jersey Communities for Homeowners and Renters (ANCHOR) replaces the Homestead Rebate and expands the property tax relief to renters and tenants as well residents of continuing care retirement communities who pay the proportionate share of property taxes attributable to their unit.

If you were a homeowner in New Jersey on October 1, 2019 and your gross income was $250,000 or less you are eligible. You will be applying for a rebate on your 2019 taxes so you will need your 2019 New Jersey tax return, NJ-1040, as well as your ID and PIN numbers. Homeowners who filed for Homestead Rebates last year can retrieve their PIN and ID at the NJ Division of Taxation website, https://www.state.nj.us/treasury/taxation/, by clicking “to obtain ID and PIN numbers online”.

If you were a homeowner in New Jersey on October 1, 2019 and your gross income was $250,000 or less you are eligible. You will be applying for a rebate on your 2019 taxes so you will need your 2019 New Jersey tax return, NJ-1040, as well as your ID and PIN numbers. Homeowners who filed for Homestead Rebates last year can retrieve their PIN and ID at the NJ Division of Taxation website, https://www.state.nj.us/treasury/taxation/, by clicking “to obtain ID and PIN numbers online”.

Renters are eligible for ANCHOR rebates of $450 if their 2019 New Jersey Gross Income was not more than $150,000, they occupied the rental as their principal residence on October 1, 2019, and their name was on the lease or rental agreement. If you need assistance applying for ANCHOR or finding your ID and PIN numbers please contact my Senate office at SenGopal@njleg.org, or (732) 695-3371. The state Department of Treasury will begin mailing rebates in the spring or depositing them directly to people who opt for direct deposit when they apply.

We can also help with other programs, including the Property Tax Reimbursement program known as Senior Freeze, which lets seniors “freeze” their property taxes at the current year amount and receive a rebate check in following years for the difference between the “frozen” year and what they pay each new tax year.

The deadline to apply for Senior Freeze is October 31, 2023.

Seniors are eligible for Senior Freeze if you owned and lived in your home since December 31, 2018, or earlier and you still owned and lived in that home on December 31, 2022.

We are also helping veterans apply for the Veterans Income Tax Exemption which exempts $6,000 on your New Jersey Income Tax return. Veterans need their Certificate of Release or Discharge from Active Duty (DD-214).

My Senate office can provide additional information on eligibility and assist residents in applying Senior Freeze and the Veterans Income Tax Exemption.

We continue to take help for residents on the road with Mobile Office Hours, visiting LD11 towns to assist people where they live. As the weather warms, we are able to increase our Mobile Office Hours by scheduling some of them outdoors. In addition to the programs above, the staff can help residents navigate other state programs and departments, including the Motor Vehicle Commission and unemployment insurance, during Mobile Office Hours.

I urge you to call our Senate office in advance and let us know you’re coming to Mobile Office Hours so we can make sure you know what documents you need to bring and we can have any documents or applications you may need on hand. If you are applying for Senior Freeze you will need to bring income tax forms for 2021 and 2022, photo identification, a copy of your property tax bill, and proof of other applicable income.

Please follow us on Facebook at facebook.com/senatorgopal for information about Mobile Office Hours near you or call us at (732) 695-3371.

###

Senator Vin Gopal is chair of the Senate Education Committee. He represents residents of Asbury Park, Allenhurst, Colts Neck, Deal, Eatontown, Freehold, Freehold Township, Interlaken, Loch Arbor, Long Branch, Neptune City, Neptune Township, Ocean Township, Red Bank, Tinton Falls, Shrewsbury, Shrewsbury Township, and West Long Branch.